How Animals Risk Defense (LRP) Insurance Policy Can Protect Your Animals Investment

Livestock Risk Defense (LRP) insurance coverage stands as a trustworthy guard against the uncertain nature of the market, using a critical strategy to safeguarding your assets. By delving into the ins and outs of LRP insurance policy and its multifaceted benefits, livestock manufacturers can strengthen their financial investments with a layer of safety that transcends market variations.

Recognizing Livestock Threat Protection (LRP) Insurance

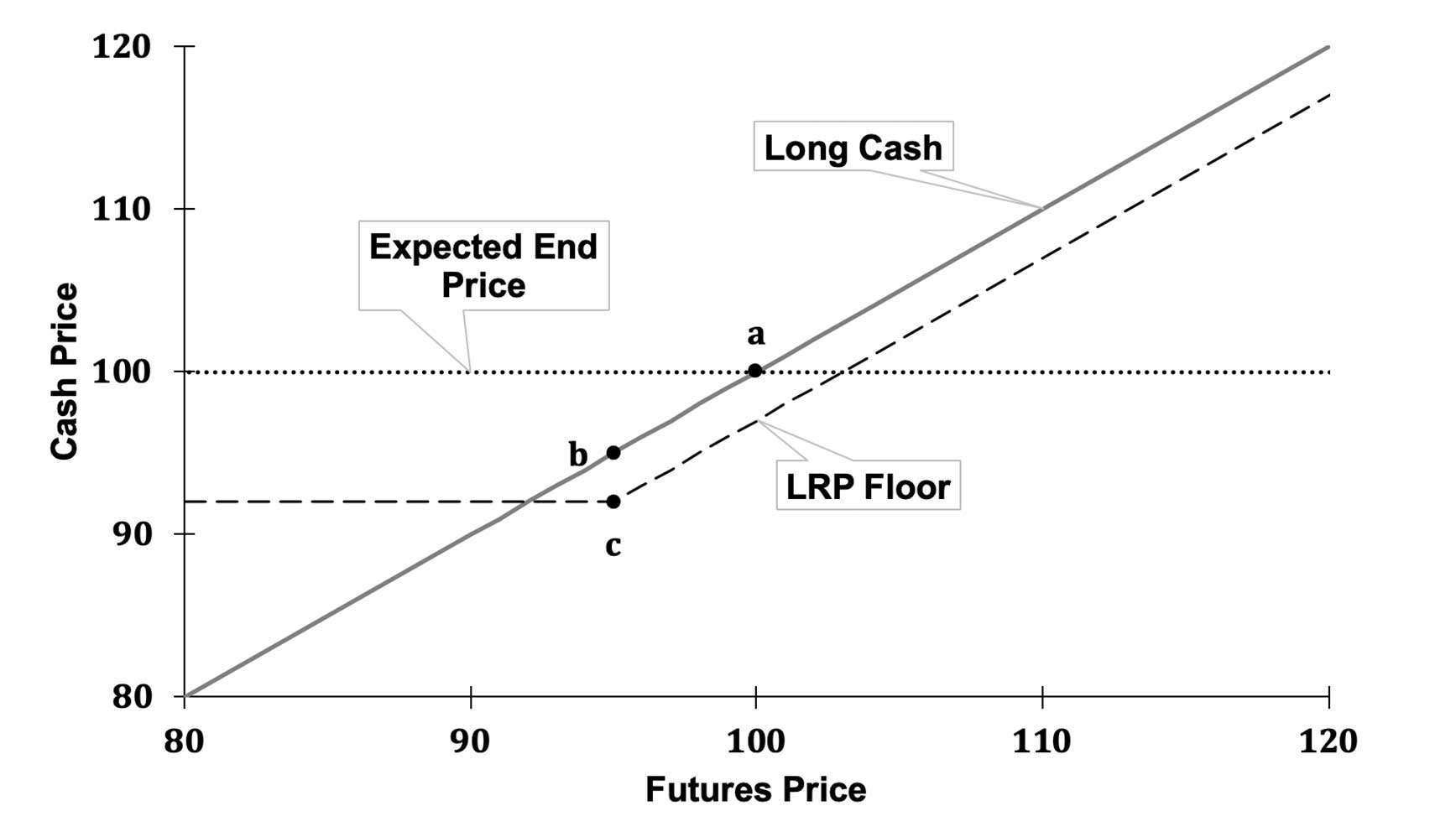

Recognizing Livestock Threat Protection (LRP) Insurance policy is vital for livestock manufacturers aiming to alleviate economic risks connected with rate changes. LRP is a government subsidized insurance coverage product designed to shield producers versus a decline in market value. By supplying insurance coverage for market value declines, LRP assists manufacturers secure a flooring rate for their animals, ensuring a minimal level of profits no matter market changes.

One trick facet of LRP is its versatility, enabling manufacturers to customize insurance coverage levels and policy sizes to suit their certain demands. Producers can select the variety of head, weight array, insurance coverage cost, and protection period that straighten with their production goals and take the chance of tolerance. Comprehending these personalized options is crucial for producers to properly handle their cost danger direct exposure.

In Addition, LRP is available for different animals kinds, consisting of cattle, swine, and lamb, making it a versatile danger monitoring device for animals producers across different industries. Bagley Risk Management. By acquainting themselves with the details of LRP, manufacturers can make informed decisions to protect their investments and make sure economic security despite market uncertainties

Benefits of LRP Insurance for Livestock Producers

Livestock manufacturers leveraging Animals Threat Defense (LRP) Insurance get a critical advantage in shielding their financial investments from cost volatility and protecting a steady monetary footing in the middle of market uncertainties. One essential benefit of LRP Insurance coverage is cost security. By establishing a floor on the cost of their animals, producers can alleviate the threat of substantial monetary losses in the occasion of market declines. This enables them to intend their budgets extra properly and make notified decisions concerning their procedures without the continuous worry of price fluctuations.

Furthermore, LRP Insurance policy offers manufacturers with comfort. Understanding that their investments are protected against unforeseen market changes enables producers to focus on other facets of their service, such as improving animal health and wellness and welfare or maximizing production procedures. This comfort can lead to boosted performance and productivity in the lengthy run, as manufacturers can run with more confidence and security. In general, the benefits of LRP Insurance policy for animals producers are substantial, providing her explanation an important device for managing risk and guaranteeing economic safety and security in an unpredictable market environment.

Exactly How LRP Insurance Coverage Mitigates Market Dangers

Reducing market risks, Livestock Risk Defense (LRP) Insurance policy supplies animals manufacturers with a trustworthy guard versus price volatility and monetary unpredictabilities. By using security versus unanticipated cost declines, LRP Insurance assists manufacturers secure their site web financial investments and preserve financial security in the face of market variations. This sort of insurance policy allows animals manufacturers to lock in a price for their pets at the beginning of the policy duration, ensuring a minimum rate degree regardless of market modifications.

Actions to Safeguard Your Animals Investment With LRP

In the world of farming threat monitoring, carrying out Animals Risk Security (LRP) Insurance entails a tactical procedure to secure financial investments versus market variations and uncertainties. To secure your livestock financial investment effectively with LRP, the very first action is to assess the particular risks your operation encounters, such as price volatility or unforeseen weather condition events. Next, it is critical to research study and select a trusted insurance provider that supplies LRP plans customized to your animals and service needs.

Long-Term Financial Protection With LRP Insurance Policy

Ensuring enduring monetary security through the usage of Animals Threat Security (LRP) Insurance is a sensible long-lasting approach for agricultural producers. By incorporating LRP Insurance policy right into their threat monitoring plans, farmers can safeguard their animals financial investments versus unforeseen market variations and adverse occasions that could endanger their monetary health gradually.

One secret benefit of LRP Insurance coverage for long-lasting financial security is the comfort it uses. With a dependable insurance plan in location, farmers use this link can minimize the monetary risks connected with volatile market problems and unanticipated losses as a result of factors such as condition outbreaks or natural calamities - Bagley Risk Management. This security enables manufacturers to concentrate on the daily procedures of their livestock organization without constant bother with potential monetary setbacks

Moreover, LRP Insurance coverage gives a structured strategy to managing threat over the long-term. By setting specific protection levels and selecting ideal endorsement durations, farmers can customize their insurance policy intends to line up with their financial goals and take the chance of resistance, making sure a lasting and secure future for their animals operations. Finally, spending in LRP Insurance is a proactive technique for farming manufacturers to achieve lasting monetary protection and safeguard their livelihoods.

Verdict

In final thought, Livestock Risk Protection (LRP) Insurance coverage is a beneficial device for livestock manufacturers to alleviate market threats and protect their investments. It is a sensible choice for protecting livestock financial investments.